What Is Cost Unit

In the world of finance and accounting, understanding the concept of a cost unit is crucial for effective cost management and decision-making. A cost unit serves as a fundamental building block in the analysis and allocation of costs, providing valuable insights for businesses to optimize their operations and make informed choices.

This article delves into the intricate details of cost units, exploring their definition, significance, and practical applications. By the end of this comprehensive guide, you'll have a thorough understanding of cost units and their role in the financial landscape.

Understanding Cost Units

A cost unit, in its essence, is a measurable unit of output, service, or activity for which costs are accumulated and controlled. It represents the basic element to which costs are directly associated, allowing for a precise analysis of the cost structure within an organization.

Cost units provide a standardized approach to cost accounting, enabling businesses to allocate resources efficiently and make strategic decisions based on accurate cost information. By defining specific cost units, companies can track and manage costs associated with their products, services, or activities, ensuring a comprehensive understanding of their financial performance.

Examples of Cost Units

The concept of cost units can be applied across various industries and business contexts. Here are some real-world examples to illustrate the practical implementation of cost units:

- Manufacturing: In a manufacturing setting, a cost unit could be a single unit of a product, such as a smartphone or a pair of shoes. By tracking the costs associated with each unit, companies can determine the production cost, identify cost drivers, and optimize their manufacturing processes.

- Service Industry: For service-based businesses, such as a consulting firm or a law practice, a cost unit might be represented by a specific service or project. By assigning costs to these units, professionals can accurately bill clients and analyze the profitability of different services or projects.

- Healthcare: In healthcare settings, a cost unit could be a patient or a specific medical procedure. Tracking costs at this level helps hospitals and clinics understand the cost structure of different treatments, allocate resources effectively, and improve the overall efficiency of healthcare delivery.

- Retail: Retail businesses often use cost units to track the costs associated with individual products or product categories. By analyzing these costs, retailers can optimize their pricing strategies, manage inventory levels, and make informed decisions about product sourcing and promotion.

Significance of Cost Units

Cost units are vital for several reasons, offering a range of benefits to businesses and accounting professionals:

- Cost Control: By defining cost units, organizations can effectively control and manage their costs. This enables them to identify areas of inefficiency, reduce waste, and optimize their cost structure, ultimately improving profitability.

- Decision-Making: Cost units provide essential data for making informed decisions. Whether it's determining pricing strategies, assessing the profitability of different products or services, or evaluating the impact of cost-saving initiatives, cost units serve as a critical tool for strategic planning.

- Performance Evaluation: Cost units allow businesses to evaluate their performance at a granular level. By comparing actual costs with budgeted or standard costs, organizations can identify variances, assess the effectiveness of their operations, and make necessary adjustments to improve overall performance.

- Cost Allocation: Cost units facilitate the allocation of costs to different departments, products, or services. This ensures that costs are distributed fairly and accurately, allowing for a more precise understanding of the cost drivers within the organization.

Types of Cost Units

Cost units can be categorized into various types, depending on the nature of the business and the specific needs of cost analysis. Here are some common types of cost units:

- Physical Units: These are tangible units of output, such as units of a manufactured product or the number of patients treated in a hospital. Physical units provide a direct and measurable basis for cost allocation and analysis.

- Service Units: Service units represent the output of service-based businesses. Examples include the number of consulting hours, legal cases handled, or the volume of customer inquiries. Service units help service providers allocate costs and determine their service pricing.

- Activity-Based Costing (ABC) Units: ABC units are based on the activities performed within an organization. They allocate costs to specific activities, such as production setup, customer service interactions, or research and development projects. ABC units provide a more accurate cost allocation method by considering the resources consumed by each activity.

- Cost Pools: Cost pools are collections of similar costs that are grouped together for analysis and allocation. They are particularly useful when dealing with indirect costs, such as administrative expenses or overhead costs. Cost pools allow for a more efficient and systematic allocation of these costs to different cost units.

Cost Unit Analysis

Cost unit analysis involves a systematic examination of the costs associated with a specific cost unit. This analysis provides valuable insights into the cost structure, cost drivers, and potential areas for cost reduction or improvement.

Here's a breakdown of the key steps involved in cost unit analysis:

- Identify Cost Units: The first step is to define the appropriate cost units for the business. This involves considering the nature of the organization's products, services, or activities and selecting cost units that align with its operations.

- Gather Cost Data: Collect detailed cost information for each identified cost unit. This includes both direct and indirect costs, such as raw materials, labor, overhead expenses, and any other relevant expenses.

- Analyze Cost Drivers: Identify the factors that influence the costs associated with each cost unit. Cost drivers could include production volume, labor hours, material usage, or any other variable that impacts the cost structure.

- Allocate Costs: Allocate the gathered costs to the respective cost units based on the identified cost drivers. This step ensures that costs are fairly distributed and provides a clear understanding of the cost composition for each unit.

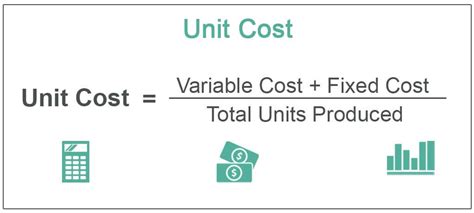

- Calculate Cost Rates: Determine the cost rates or cost per unit for each cost unit. This involves dividing the total allocated costs by the number of cost units. Cost rates provide a basis for pricing decisions, cost comparisons, and performance evaluation.

- Analyze Variances: Compare the actual costs with the expected or standard costs for each cost unit. Variances indicate deviations from the budgeted or planned costs, highlighting areas of concern or improvement.

- Implement Cost Reduction Strategies: Based on the analysis, develop and implement cost reduction strategies. This could involve optimizing processes, negotiating better supplier contracts, improving efficiency, or reallocating resources to lower-cost alternatives.

Benefits of Cost Unit Analysis

Cost unit analysis offers a range of benefits to businesses, helping them gain a competitive edge and improve their financial performance. Here are some key advantages:

- Improved Cost Control: By analyzing cost units, businesses can identify areas where costs are excessive or can be optimized. This leads to better cost management and control, resulting in increased profitability.

- Enhanced Decision-Making: Cost unit analysis provides valuable data for making informed decisions. Whether it's pricing strategies, product mix decisions, or investment choices, cost unit analysis ensures that decisions are based on accurate cost information.

- Increased Operational Efficiency: Through cost unit analysis, organizations can pinpoint inefficiencies and bottlenecks in their operations. By addressing these issues, businesses can streamline their processes, reduce waste, and improve overall operational efficiency.

- Strategic Planning: Cost unit analysis plays a crucial role in strategic planning. It helps businesses understand the cost structure of their products or services, identify cost-saving opportunities, and develop strategies to maintain a competitive advantage.

- Effective Cost Allocation: Cost unit analysis ensures that costs are allocated accurately and fairly. This enables businesses to allocate resources efficiently, improving the overall financial performance and decision-making capabilities.

Future Implications and Innovations

The field of cost accounting and cost unit analysis is continuously evolving, driven by advancements in technology and changing business dynamics. Here are some future implications and potential innovations in cost unit analysis:

- Data Analytics and AI: The integration of data analytics and artificial intelligence (AI) in cost unit analysis can revolutionize the process. AI-powered systems can automate data collection, analyze large datasets, and provide real-time insights, enhancing the accuracy and efficiency of cost unit analysis.

- Activity-Based Costing (ABC) Evolution: ABC, as a cost unit analysis technique, is expected to evolve further. Advanced ABC models and tools will allow businesses to delve deeper into their cost structures, capturing more detailed cost information and providing a more nuanced understanding of cost drivers.

- Sustainable Cost Management: With growing environmental concerns, sustainable cost management practices are gaining importance. Cost unit analysis can be extended to include environmental factors, helping businesses identify and reduce their carbon footprint while optimizing costs.

- Cloud-Based Cost Accounting: Cloud-based accounting platforms are gaining traction, offering remote access to cost data and analysis tools. This trend is expected to continue, enabling businesses to collaborate and analyze cost units more efficiently across different locations and teams.

- Integration with ERP Systems: The integration of cost unit analysis with Enterprise Resource Planning (ERP) systems can streamline the cost accounting process. By combining cost data with other operational data, businesses can gain a holistic view of their cost structure and make more informed decisions.

Conclusion

Cost units are a fundamental concept in cost accounting, providing a structured approach to cost analysis and management. By understanding the significance of cost units and implementing effective cost unit analysis techniques, businesses can optimize their cost structures, improve decision-making, and enhance their overall financial performance.

As technology advances and business environments evolve, the field of cost unit analysis is poised for further innovation. By embracing these advancements and staying abreast of emerging trends, businesses can stay ahead of the curve and maintain a competitive edge in the dynamic world of finance and accounting.

What is the primary purpose of cost unit analysis?

+

Cost unit analysis serves as a critical tool for businesses to understand their cost structure, identify cost drivers, and make informed decisions regarding cost management and optimization.

How do cost units help in decision-making?

+

Cost units provide valuable data on the costs associated with different products, services, or activities. This information enables businesses to make strategic decisions, such as pricing strategies, product mix choices, and investment decisions, based on accurate cost information.

Can cost unit analysis be applied to service-based businesses?

+

Absolutely! Cost unit analysis is highly applicable to service-based businesses. By defining cost units based on service outputs or projects, service providers can accurately allocate costs, evaluate the profitability of different services, and make informed decisions regarding their service offerings.

How often should cost unit analysis be conducted?

+

The frequency of cost unit analysis depends on the nature of the business and its cost structure. Some businesses may conduct cost unit analysis on a quarterly or annual basis, while others may require more frequent analysis, especially in dynamic or rapidly changing industries.

What are the potential challenges in cost unit analysis?

+

Challenges in cost unit analysis can include accurately identifying cost drivers, especially in complex or multi-faceted businesses. Additionally, ensuring the reliability and accuracy of cost data can be a challenge, especially when dealing with indirect costs or cost pools.